Transforming Car Purchases with Digital Finance

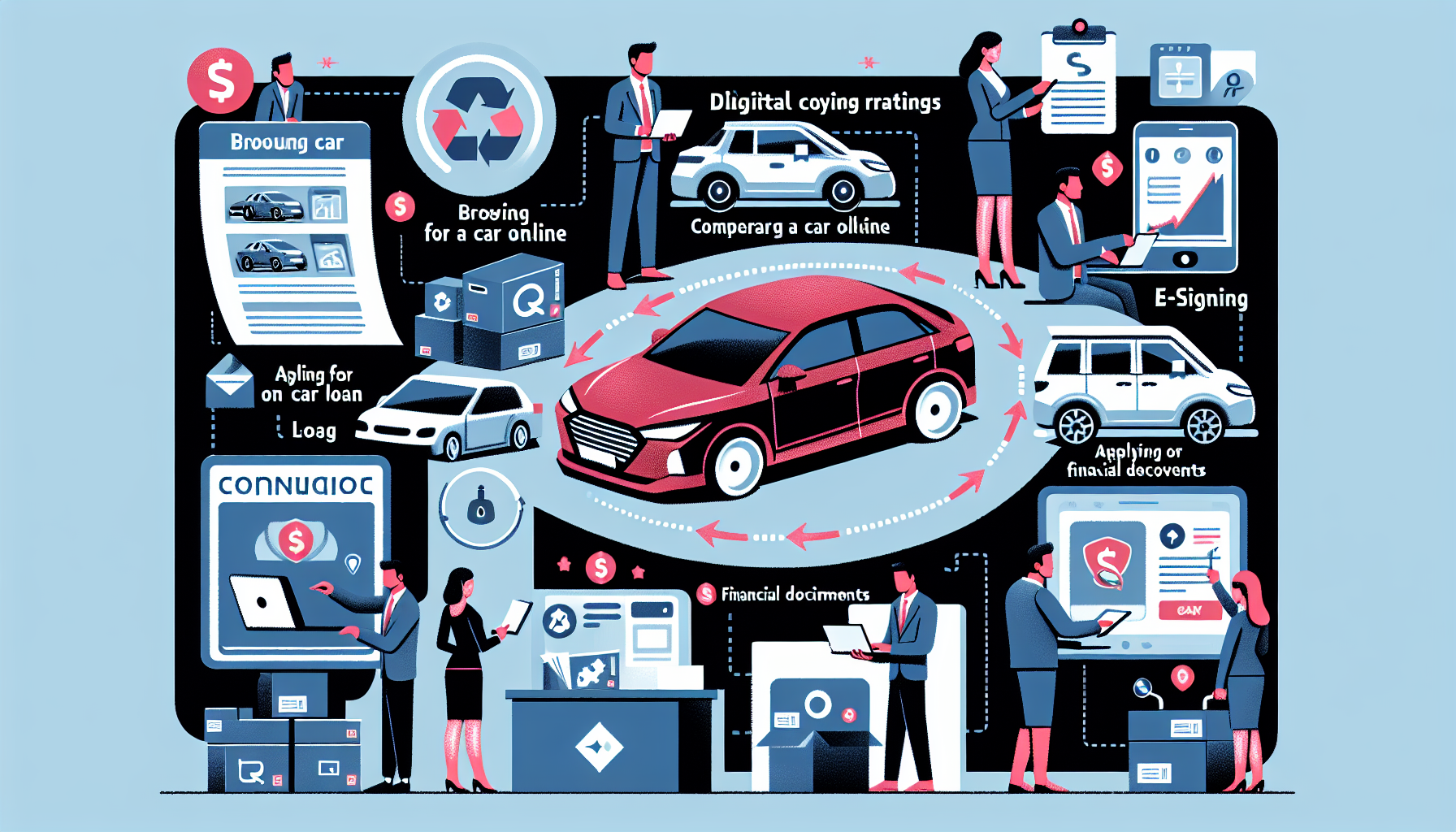

Digital financial innovation refers to the integration of advanced technologies in financial services, transforming how consumers and businesses interact with money. This includes the use of mobile banking, online payment systems, and blockchain technology to streamline financial transactions. In the context of the car buying process, these innovations are reshaping how consumers purchase vehicles, offering more convenience, transparency, and efficiency.

Streamlining the Buying Process

The traditional car buying process often involves lengthy negotiations, paperwork, and multiple visits to dealerships. However, digital financial innovations are simplifying this process. Online platforms now allow consumers to compare prices, apply for loans, and even complete purchases from the comfort of their homes. This shift not only saves time but also enhances the overall buying experience by providing more control to the consumer.

Benefits of Digital Finance in Car Buying

1. **Convenience:** Buyers can explore options and secure financing online without visiting multiple dealerships.

2. **Transparency:** Digital platforms offer clear information on pricing, financing options, and vehicle history.

3. **Efficiency:** Automated processes reduce the time spent on paperwork and negotiations.

4. **Accessibility:** More consumers can access financing options tailored to their needs.

Online car marketplaces have become a pivotal part of the car buying process. These platforms aggregate listings from various dealerships, providing a one-stop-shop for consumers. They offer tools for comparing vehicles, calculating loan payments, and even arranging test drives. By leveraging digital financial tools, these marketplaces enhance the buying process, making it more user-friendly and efficient.

Financing Innovations

Digital financial innovation has also transformed vehicle financing. Traditional auto loans often required extensive paperwork and in-person visits to banks. Today, consumers can apply for loans online, receive instant approvals, and choose from a variety of financing options. This flexibility allows buyers to secure the best rates and terms, tailored to their financial situation.

Digital Financing Tools

– **Online Loan Calculators:** Help buyers estimate monthly payments and total loan costs.

– **Pre-Approval Services:** Allow consumers to secure financing before visiting a dealership.

– **Digital Contracts:** Enable electronic signing, reducing the need for physical paperwork.

Blockchain technology is emerging as a game-changer in the car buying process. By using blockchain, transactions become more secure and transparent. Smart contracts, which are self-executing contracts with the terms directly written into code, can automate and enforce agreements between buyers and sellers. This reduces the risk of fraud and ensures that all parties adhere to the agreed terms.

Challenges and Considerations

Despite the benefits, digital financial innovation in car buying presents challenges. Consumers must be cautious of data privacy and security risks. Additionally, not all consumers are comfortable with digital transactions, which can create a barrier to adoption. It’s crucial for platforms to provide robust security measures and user-friendly interfaces to build trust and encourage wider acceptance.

Overcoming Challenges

– **Education:** Providing resources to help consumers understand digital tools.

– **Security:** Implementing strong encryption and data protection measures.

– **Support:** Offering customer service to assist with digital transactions.

The future of car buying is set to become even more digital and personalized. As technology continues to evolve, we can expect further integration of artificial intelligence and machine learning to offer tailored recommendations and financing options. Virtual reality may also play a role, allowing consumers to experience vehicles in a virtual showroom environment.

Conclusion

Digital financial innovation is revolutionizing the car buying process, making it more efficient, transparent, and consumer-friendly. By embracing these technologies, both consumers and dealerships can benefit from a streamlined and enhanced buying experience. As the industry continues to evolve, staying informed and adaptable will be key to navigating the future of car purchases.

Embrace the Change

The integration of digital finance in car buying is not just a trend but a significant shift in how we approach vehicle purchases. Embrace these innovations to enjoy a more seamless and efficient buying experience. Stay informed, stay secure, and enjoy the ride!